Homes for equity research project

What is Homes for Equity?

Homes for Equity (HFE) researched a way to create equitable access to homeownership for People of Color who have experienced housing discrimination, allowing them to build and to benefit from intergenerational wealth.

Why is homeownership so important?

Homeownership is not only part of the American dream, it is also how many families build economic security. Parents use the equity in their homes to pay for college or provide home purchase assistance for their children. Yet for decades, white households bought homes and generated wealth supported by public policies and private actions that excluded Black households from buying homes, contributing to stark racial inequality in wealth.

Stories of discrimination

As part of our research on housing discrimination, we interviewed Roxbury residents who have experienced it. Meet the participants of our oral history project and hear their stories.

Report release: City, state, and industry roles in housing discrimination

To achieve housing and wealth equity requires that we acknowledge historic and current discriminatory housing practices and explicitly commit to remedying the economic harm.

We and our partners at StarLuna Consulting have done extensive research to document the history of harm caused by housing discrimination in Roxbury Massachusetts.

Our reports show the pervasiveness of housing discrimination across many decades, and illustrate the ways both historical and current policies and patterns of discrimination harm potential homebuyers of color.

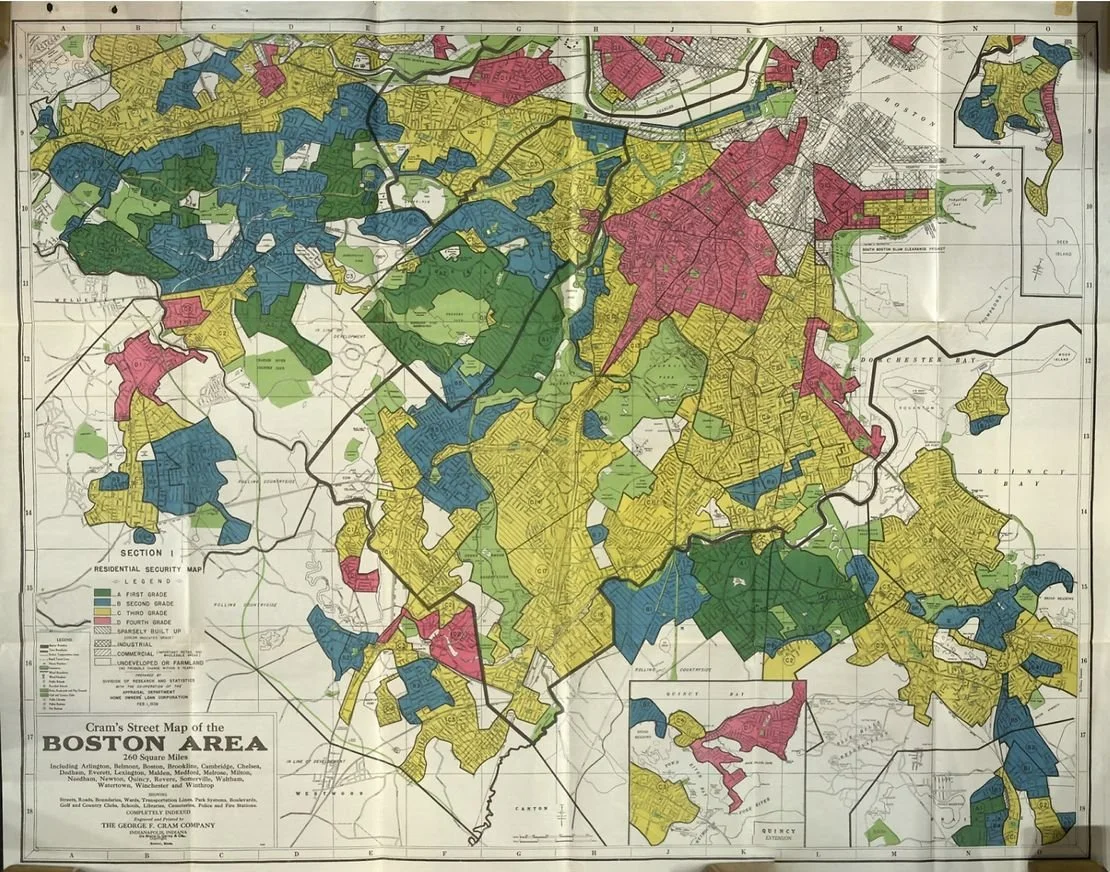

The Housing Ownership Loan Corporation, established by the US Congress in the 1930s, created Residential Security maps color-coded based on the “risk” level of the area: red for hazardous, yellow for declining, blue for desirable, and green for best. Thus the harmful practice of “red-lining” began.

Source: www.bostonpoliticalreview.org

Did you know?

Decades of redlining, predatory lending, and other discriminatory practices have denied Black households both access and opportunity to own homes.

Massachusetts ranks 46th in the country for homeownership disparities, and white families are two times more likely to own a home than Black families.

The Federal Reserve Bank of Boston found that white households in Boston have $247,000 in assets on average, while Black households have assets of only $8.